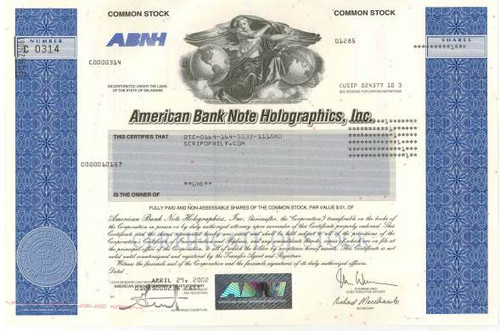

Beautifully engraved Certificate from the American Bank Note Holographics, Inc . This historic document was printed by the American Banknote Company and has an ornate border with vignettes of an allegorical woman and the company's name in a holograph. This item has the printed signatures of the company's officers including Morris Weissman as President and Richard Macchiarulo, as Secretary. Holographs on stock certificates are very scarce.

Certificate Vignette

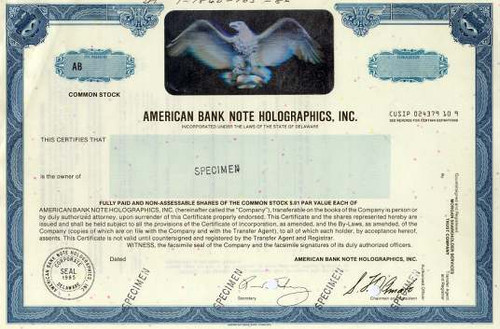

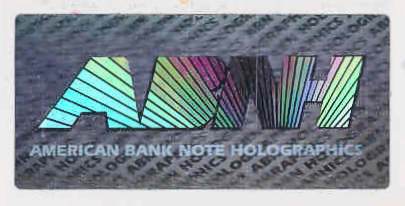

Certificate Holograph American Bank Note Holographics ("ABNH") has been a pioneer and world leader in holography, with a focus on security applications for 20 years. ABNH is in many ways a new company today. With new management that started in 1999, ABNH has been revitalized with a host of innovations developed to meet the needs of its diverse marketplace. The new ABNH is stronger than ever, with new leadership building on its heritage and international reputation for innovation and faithful service to its customers. The need for holographic security applications has never been greater. Governments, corporations and citizens worldwide are faced with an increased threat of counterfeiting as a result of new technologies in the hands of counterfeiters. Counterfeiting has become a $500+ billion annual problem and is continuing to increase.

On August 8, 2003, a jury found that Morris Weissman, former chairman and CEO of American Banknote, had inflated his company's earnings in 1996 and 1997. Based on the false numbers, the 1998 public offering of the company's subsidiary, American Banknote Holographics, was a success, netting the company $115 million. When the accounting fraud was uncovered in early 1999, the spinoff's shares dropped from about $16 a share to $1.80 a share. The stock was delisted in August 1999. As a result of the fraud, investors were bilked of more than $100 million, prosecutors say. While that sum pales in comparison with the money lost through the accounting frauds at Enron and WorldCom, the conviction is significant. Below is the complaint originally filed by the Securities and Exchange Commission: SECURITIES AND EXCHANGE COMMISSION Washington, D.C. LITIGATION RELEASE NO. 17068A \ July 18, 2001 ACCOUNTING AUDITING ENFORCEMENT RELEASE NO. 1425 SEC v. MORRIS WEISSMAN, JOSHUA CANTOR, JOHN GORMAN, and PATRICK GENTILE, Civil Action No. 01 CV 6449 (JSR) (S.D.N.Y. July 18, 2001) SEC v. AMERICAN BANKNOTE CORPORATION, Civil Action No. 01 CV 6450 (JSR) (S.D.N.Y. July 18, 2001) SEC v. AMERICAN BANK NOTE HOLOGRAPHICS, INC., Civil Action No. 01 CV 6453 (JSR) (S.D.N.Y. July 18, 2001) SEC v. RICHARD MACCHIARULO, Civil Action No. 01 CV 6454 (JSR) (S.D.N.Y. July 18, 2001) SEC v. ANTONIO ACCORNERO and RUSSELL MCGRANE, Civil Action No. 01 CV 6452 (JSR) (S.D.N.Y. July 18, 2001) In the Matter of AMERICAN BANK NOTE HOLOGRAPHICS, INC., Administrative Proceeding File No. 3-10532 In the Matter of MARK GOLDBERG, CPA, Administrative Proceeding No. 3-10534 In the Matter of JOHN LERLO, Administrative Proceeding No. 3-10533 SEC FILES FINANCIAL FRAUD ACTION AGAINST CURRENT AND FORMER SENIOR OFFICERS AND DIRECTORS OF AMERICAN BANKNOTE CORPORATION, AND FORMER SENIOR OFFICERS AND DIRECTORS OF AMERICAN BANK NOTE HOLOGRAPHICS, INC. - FRAUD SUITS INSTITUTED AND SETTLED AGAINST AMERICAN BANKNOTE CORPORATION, AMERICAN BANK NOTE HOLOGRAPHICS, INC., AND OTHERS The Securities and Exchange Commission today filed suit in the United States District Court for the Southern District of New York against current and former senior officers and directors of American Banknote Corporation ("ABN") and/or American Bank Note Holographics, Inc. ("ABNH") for violations of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws. The Complaint alleges that beginning with fiscal year 1996, and continuing through fiscal year 1998, the four defendants engaged in a systematic, fraudulent scheme to inflate the revenues and net income of ABNH and its publicly-held parent, ABN, in order to meet earnings forecasts and to condition the market for an initial public offering of stock by ABNH. Named as defendants in the Complaint are Morris Weissman, the former chairman of the board and chief executive officer of ABNH and the former chairman, chief executive officer, and director of ABN, Joshua Cantor, the former executive vice president and general manager of ABNH and, later, its president and a director, John Gorman, the former executive vice president and chief financial officer of ABN, and Patrick Gentile, currently a vice president and the chief accounting officer of ABN and, formerly, ABN's corporate controller. ABN is a holding company, incorporated in Delaware with its principal offices located in New York, New York, which, through its subsidiaries, provides, among other things, stored-value telephone cards, magnetic-strip transaction cards, printed business forms, and checks. ABNH, a Delaware Corporation with its principal executive offices located in Elmsford, New York, is engaged in the origination, production, and marketing of mass-produced secure holograms. ABNH remained a wholly owned subsidiary of ABN until its initial public offering in July 1998. In related actions, the Commission also filed settled antifraud injunctive actions against ABN, Richard Macchiarulo, the former vice president, finance, of ABNH, and Antonio Accornero and Russell McGrane, officers of Colorado Plasticard, Inc., an ABNH customer. The Commission also instituted and simultaneously settled administrative proceedings against ABNH, Mark Goldberg, ABNH's former controller, and John Lerlo, an ABNH plant manager. The U.S. Attorney's Office for the Southern District of New York, on the same day, announced that a four count indictment had been returned against Weissman charging that he conspired to commit securities fraud, falsified corporate books and records, and provided false statements to auditors. Also, yesterday, Cantor pled guilty to a four count information charging that he conspired to commit securities fraud, falsified corporate books and records, provided false statements to auditors, and violated the Foreign Corrupt Practices Act. In addition, Macchiarulo pled guilty to a three count information charging that he conspired to commit securities fraud, falsified corporate books and records, and provided false statements to auditors. The Complaint against Weissman, Cantor, Gorman, and Gentile alleges that: During the third and fourth quarters of fiscal year 1996, Cantor, with the knowledge of Weissman, caused ABNH improperly to recognize revenue totaling approximately $645,000 on consignment sales to Colorado Plasticard and Gemplus Corp., USA. In addition, on or about January 30, 1997, in order to make it appear that ABN had met its earnings per share goals for fiscal year 1996, Cantor, Gorman, and Gentile, with the knowledge of Weissman, caused ABNH to accrue approximately $635,250 in revenue for fiscal year 1996 on two fraudulent "bill and hold" sales, one to Colorado Plasticard and the other to Gemplus. In addition, the defendants caused ABNH to accrue $800,000 in fraudulent revenue for research and development ("R&D") work it had performed for Kokusai Medicom Corporation ("KMC"), a Japanese customer. To convince ABN's auditors that the 1996 fiscal year end "bill and hold" and KMC transactions were proper, Cantor secured audit confirmations from Colorado Plasticard, Gemplus, and KMC that the defendants knew, or were reckless in not knowing, were false. In addition, Weissman, Gorman, and Gentile signed a management representation letter, given to ABN's auditors during ABN's fiscal year 1996 audit, that they knew, or were reckless in not knowing, was materially false and misleading. In fiscal year 1997, Cantor, with Weissman's knowledge, caused ABNH improperly to recognize revenue of over $1.8 million on consignment sales and to recognize improperly revenue of approximately $1.3 million on a December 31, 1997 shipment of unusable work in process to Colorado Plasticard that Cantor and Weissman knew, or were reckless in not knowing, would be returned to ABNH in fiscal year 1998. In addition, in December 1997, Weissman and Cantor caused ABNH to fraudulently recognize approximately $6 million in revenue on a "bill and hold" sale to MasterCard when they knew, or were reckless in not knowing, that the holograms sold had not actually been completed by the subcontractor, Crown Roll Leaf, by December 31, 1997. Thereafter, in connection with ABN's fiscal year 1997 audit, Weissman and Cantor misled ABN's auditors into believing that the holograms Crown Roll produced were completed, and delivered to ABNH's facility, by December 31, 1997. In addition to the false and misleading statements made to confirm the MasterCard transaction, Cantor obtained false audit confirmations from Colorado Plasticard (which Weissman knew about) and Gemplus, which were given to ABN's auditors to conceal fraudulent fiscal year 1997 sales. Also, during the audit, Weissman, Cantor, Gorman, and Gentile provided to ABN's auditors a management representation letter that they knew, or were reckless in not knowing, was false and misleading. In fiscal year 1998, Cantor, with Weissman's knowledge, caused ABNH fraudulently to recognize approximately $26 million in revenue through consignment sales, shipments to warehouses, and sales of product that was never shipped, that was returned, and that was test material. In addition, in late 1998,Weissman and Cantor violated the anti-bribery provisions of the federal securities laws by causing ABNH to pay $239,000 to a Swiss bank account for the purpose of influencing or affecting the acts or decisions of one or more Saudi Arabian officials, or the Saudi Arabian government, to assist ABNH in obtaining or retaining business with that government. In its Complaint, the Commission requests that the Court issue a final judgment of permanent injunction and other relief restraining and enjoining Weissman, Cantor, Gorman, and Gentile from violating and/or aiding and abetting violations of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws, Section 17(a) of the Securities Act of 1933 ("Securities Act"), Sections 10(b), 13(a), 13(b)(2)(A), 13(b)(2)(B), and 13(b)(5) of the Securities Exchange Act of 1934 ("Exchange Act"), and Exchange Act Rules 10b-5, 12b-20, 13a-1, 13a-13, 13b2-1, and 13b2-2, and, as to Weissman and Cantor, violating the anti-bribery provisions of the federal securities laws, Section 30A of the Exchange Act. The Commission also is seeking an order that Weissman and Cantor be prohibited from acting as an officer or director of a public company, that the defendants disgorge certain compensation and trading profits, and that the defendants pay civil penalties. SEC SETTLES FRAUD CHARGES WITH ABN AND ABNH In a related action, the Commission filed a settled injunctive action against ABN pursuant to which ABN, without admitting or denying the allegations of the Complaint, consented to an order permanently restraining and enjoining it from violating the antifraud, periodic reporting, record keeping, and internal controls provisions of the federal securities laws, Section 17(a) of the Securities Act, Sections 10(b), 13(a), and 13(b)(2)(A) and 13(b)(2)(B) of the Exchange Act, and Exchange Act Rules 10b-5, 12b-20, 13a-1, and 13a-13. The Commission also instituted and simultaneously settled an administrative cease-and-desist proceeding against ABNH pursuant to which ABNH, without admitting or denying the Commission's findings, consented to an order requiring it to cease and desist from committing or causing any violation, and any future violation, of the antifraud, periodic reporting, record keeping, internal controls, and anti-bribery provisions of the federal securities laws. In connection with this settlement, the Commission filed a civil penalty proceeding and ABNH, without admitting or denying the allegations of the Commission's Complaint, has consented to pay a $75,000 civil penalty for its violation of the anti-bribery provisions of the federal securities laws. SEC SETTLES WITH MACCHIARULO, GOLDBERG, AND LERLO WITH RESPECT TO VIOLATIONS ARISING FROM THEIR CONDUCT AT ABNH Richard Macchiarulo, without admitting or denying the Commission's allegations, has consented to the entry of a Final Judgment settling the Commission's Complaint against him. The Complaint alleges that with regard to fiscal year 1997, Macchiarulo caused ABNH to recognize improperly $1.3 million in revenue on the shipment of unusable work in process to Colorado Plasticard and approximately $6 million in revenue on the MasterCard transaction. The Complaint also alleges that Macchiarulo misled ABN's auditors in connection with their efforts to confirm the MasterCard transaction and that Macchiarulo was aware Colorado Plasticard signed a false audit confirmation with respect to the shipment of unusable work in process at fiscal year-end 1997. The Complaint further alleges that Macchiarulo signed the management representation letter in connection with the fiscal 1997 audit knowing that the letter was false and misleading. The Complaint also alleges that with regard to fiscal year 1998, Macchiarulo caused ABNH to recognize improperly over $5.8 million in revenue on consignment sales and shipments to warehouses during the second and third quarters and that during the fourth quarter, Macchiarulo caused ABNH to record improperly over $11.3 million in revenue on its books and records for, among other things, consignment sales, shipments to warehouses, product that was never shipped, product that was returned, and test material. Finally, the Complaint alleges that Macchiarulo told a friend in December 1998, that it would be a good time for the friend to sell his ABNH stock. According to the Complaint, Macchiarulo's friend then sold his stock and avoided losses of $16,218. Macchiarulo consented to an order permanently restraining and enjoining him from violating and/or aiding and abetting violations of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws, Section 17(a) of the Securities Act, Sections 10(b), 13(a), 13(b)(2)(A), 13(b)(2)(B) and 13(b)(5) of the Exchange Act, and Rules 10b-5, 12b-20, 13a-1, 13a-13, 13b2-1, and 13b2-2 thereunder. Macchiarulo also consented to be prohibited, for a period of ten years, from acting as an officer or director of a public company, agreed to pay disgorgement, including prejudgment interest, in the amount of $19,412.82, representing the losses his tippee avoided, and agreed to pay a $8,109 civil penalty pursuant to the Insider Trading Sanctions Act of 1984. Following the entry of an injunction, Macchiarulo also has consented to the entry of a Commission Order pursuant to Rule 102(e) of the Commission's Rules of Practice, permanently suspending him from appearing or practicing before the Commission as an accountant. The Commission also instituted and simultaneously settled an administrative cease-and-desist and Rule 102(e) proceeding against Mark Goldberg, ABNH's controller from 1993 through June 1997. The Commission found that Goldberg was directly involved in recognizing revenue for, and then confirming to ABN's auditors, the Colorado Plasticard, Gemplus, and KMC transactions which he knew, or was reckless in not knowing, were fraudulent. Without admitting or denying the Commission's findings, Goldberg consented to an order requiring him to cease and desist from committing and/or causing any violation, or any future violation, of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws. Goldberg also agreed to be denied the privilege of appearing or practicing before the Commission as an accountant, with a right to apply for reinstatement in three years. The Commission also instituted and simultaneously settled an administrative cease and desist proceeding against John Lerlo, an ABNH plant manager, for his role in altering documents and creating false memoranda related to the MasterCard transaction. Without admitting or denying the Commission's findings, Lerlo consented to an order requiring him to cease and desist from committing and/or causing any violation, and any future violation, of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws. SEC SETTLES WITH ANTONIO ACCORNERO AND RUSSELL MCGRANE, OFFICERS OF COLORADO PLASITCARD, FOR AIDING AND ABETTING FRAUD The Commission also filed a settled injunctive action against Antonio Accornero, president of Colorado Plasticard, and Russell McGrane, CFO of Colorado Plasticard. In its Complaint, the Commission alleged that Accornero and McGrane aided and abetted ABN's violations by assisting ABNH in recognizing, and then confirming to ABN's auditors, the fraudulent "bill and hold" sale for fiscal year 1996 and the $1.3 million sale of unusable work in process for fiscal year 1997. Without admitting or denying the allegations of the Complaint, Accornero and McGrane consented to being permanently restrained and enjoining from violating, or aiding and abetting violations of, the antifraud, periodic reporting, and lying to auditors provisions of the federal securities laws, Sections 10(b) and 13(a) of the Exchange Act, and Exchange Act Rules 10b-5, 13a-1, and 13b2-2, and each agreed to pay a $20,000 civil penalty.

Certificate Vignette

Certificate Holograph

On August 8, 2003, a jury found that Morris Weissman, former chairman and CEO of American Banknote, had inflated his company's earnings in 1996 and 1997. Based on the false numbers, the 1998 public offering of the company's subsidiary, American Banknote Holographics, was a success, netting the company $115 million. When the accounting fraud was uncovered in early 1999, the spinoff's shares dropped from about $16 a share to $1.80 a share. The stock was delisted in August 1999. As a result of the fraud, investors were bilked of more than $100 million, prosecutors say. While that sum pales in comparison with the money lost through the accounting frauds at Enron and WorldCom, the conviction is significant. Below is the complaint originally filed by the Securities and Exchange Commission: SECURITIES AND EXCHANGE COMMISSION Washington, D.C. LITIGATION RELEASE NO. 17068A \ July 18, 2001 ACCOUNTING AUDITING ENFORCEMENT RELEASE NO. 1425 SEC v. MORRIS WEISSMAN, JOSHUA CANTOR, JOHN GORMAN, and PATRICK GENTILE, Civil Action No. 01 CV 6449 (JSR) (S.D.N.Y. July 18, 2001) SEC v. AMERICAN BANKNOTE CORPORATION, Civil Action No. 01 CV 6450 (JSR) (S.D.N.Y. July 18, 2001) SEC v. AMERICAN BANK NOTE HOLOGRAPHICS, INC., Civil Action No. 01 CV 6453 (JSR) (S.D.N.Y. July 18, 2001) SEC v. RICHARD MACCHIARULO, Civil Action No. 01 CV 6454 (JSR) (S.D.N.Y. July 18, 2001) SEC v. ANTONIO ACCORNERO and RUSSELL MCGRANE, Civil Action No. 01 CV 6452 (JSR) (S.D.N.Y. July 18, 2001) In the Matter of AMERICAN BANK NOTE HOLOGRAPHICS, INC., Administrative Proceeding File No. 3-10532 In the Matter of MARK GOLDBERG, CPA, Administrative Proceeding No. 3-10534 In the Matter of JOHN LERLO, Administrative Proceeding No. 3-10533 SEC FILES FINANCIAL FRAUD ACTION AGAINST CURRENT AND FORMER SENIOR OFFICERS AND DIRECTORS OF AMERICAN BANKNOTE CORPORATION, AND FORMER SENIOR OFFICERS AND DIRECTORS OF AMERICAN BANK NOTE HOLOGRAPHICS, INC. - FRAUD SUITS INSTITUTED AND SETTLED AGAINST AMERICAN BANKNOTE CORPORATION, AMERICAN BANK NOTE HOLOGRAPHICS, INC., AND OTHERS The Securities and Exchange Commission today filed suit in the United States District Court for the Southern District of New York against current and former senior officers and directors of American Banknote Corporation ("ABN") and/or American Bank Note Holographics, Inc. ("ABNH") for violations of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws. The Complaint alleges that beginning with fiscal year 1996, and continuing through fiscal year 1998, the four defendants engaged in a systematic, fraudulent scheme to inflate the revenues and net income of ABNH and its publicly-held parent, ABN, in order to meet earnings forecasts and to condition the market for an initial public offering of stock by ABNH. Named as defendants in the Complaint are Morris Weissman, the former chairman of the board and chief executive officer of ABNH and the former chairman, chief executive officer, and director of ABN, Joshua Cantor, the former executive vice president and general manager of ABNH and, later, its president and a director, John Gorman, the former executive vice president and chief financial officer of ABN, and Patrick Gentile, currently a vice president and the chief accounting officer of ABN and, formerly, ABN's corporate controller. ABN is a holding company, incorporated in Delaware with its principal offices located in New York, New York, which, through its subsidiaries, provides, among other things, stored-value telephone cards, magnetic-strip transaction cards, printed business forms, and checks. ABNH, a Delaware Corporation with its principal executive offices located in Elmsford, New York, is engaged in the origination, production, and marketing of mass-produced secure holograms. ABNH remained a wholly owned subsidiary of ABN until its initial public offering in July 1998. In related actions, the Commission also filed settled antifraud injunctive actions against ABN, Richard Macchiarulo, the former vice president, finance, of ABNH, and Antonio Accornero and Russell McGrane, officers of Colorado Plasticard, Inc., an ABNH customer. The Commission also instituted and simultaneously settled administrative proceedings against ABNH, Mark Goldberg, ABNH's former controller, and John Lerlo, an ABNH plant manager. The U.S. Attorney's Office for the Southern District of New York, on the same day, announced that a four count indictment had been returned against Weissman charging that he conspired to commit securities fraud, falsified corporate books and records, and provided false statements to auditors. Also, yesterday, Cantor pled guilty to a four count information charging that he conspired to commit securities fraud, falsified corporate books and records, provided false statements to auditors, and violated the Foreign Corrupt Practices Act. In addition, Macchiarulo pled guilty to a three count information charging that he conspired to commit securities fraud, falsified corporate books and records, and provided false statements to auditors. The Complaint against Weissman, Cantor, Gorman, and Gentile alleges that: During the third and fourth quarters of fiscal year 1996, Cantor, with the knowledge of Weissman, caused ABNH improperly to recognize revenue totaling approximately $645,000 on consignment sales to Colorado Plasticard and Gemplus Corp., USA. In addition, on or about January 30, 1997, in order to make it appear that ABN had met its earnings per share goals for fiscal year 1996, Cantor, Gorman, and Gentile, with the knowledge of Weissman, caused ABNH to accrue approximately $635,250 in revenue for fiscal year 1996 on two fraudulent "bill and hold" sales, one to Colorado Plasticard and the other to Gemplus. In addition, the defendants caused ABNH to accrue $800,000 in fraudulent revenue for research and development ("R&D") work it had performed for Kokusai Medicom Corporation ("KMC"), a Japanese customer. To convince ABN's auditors that the 1996 fiscal year end "bill and hold" and KMC transactions were proper, Cantor secured audit confirmations from Colorado Plasticard, Gemplus, and KMC that the defendants knew, or were reckless in not knowing, were false. In addition, Weissman, Gorman, and Gentile signed a management representation letter, given to ABN's auditors during ABN's fiscal year 1996 audit, that they knew, or were reckless in not knowing, was materially false and misleading. In fiscal year 1997, Cantor, with Weissman's knowledge, caused ABNH improperly to recognize revenue of over $1.8 million on consignment sales and to recognize improperly revenue of approximately $1.3 million on a December 31, 1997 shipment of unusable work in process to Colorado Plasticard that Cantor and Weissman knew, or were reckless in not knowing, would be returned to ABNH in fiscal year 1998. In addition, in December 1997, Weissman and Cantor caused ABNH to fraudulently recognize approximately $6 million in revenue on a "bill and hold" sale to MasterCard when they knew, or were reckless in not knowing, that the holograms sold had not actually been completed by the subcontractor, Crown Roll Leaf, by December 31, 1997. Thereafter, in connection with ABN's fiscal year 1997 audit, Weissman and Cantor misled ABN's auditors into believing that the holograms Crown Roll produced were completed, and delivered to ABNH's facility, by December 31, 1997. In addition to the false and misleading statements made to confirm the MasterCard transaction, Cantor obtained false audit confirmations from Colorado Plasticard (which Weissman knew about) and Gemplus, which were given to ABN's auditors to conceal fraudulent fiscal year 1997 sales. Also, during the audit, Weissman, Cantor, Gorman, and Gentile provided to ABN's auditors a management representation letter that they knew, or were reckless in not knowing, was false and misleading. In fiscal year 1998, Cantor, with Weissman's knowledge, caused ABNH fraudulently to recognize approximately $26 million in revenue through consignment sales, shipments to warehouses, and sales of product that was never shipped, that was returned, and that was test material. In addition, in late 1998,Weissman and Cantor violated the anti-bribery provisions of the federal securities laws by causing ABNH to pay $239,000 to a Swiss bank account for the purpose of influencing or affecting the acts or decisions of one or more Saudi Arabian officials, or the Saudi Arabian government, to assist ABNH in obtaining or retaining business with that government. In its Complaint, the Commission requests that the Court issue a final judgment of permanent injunction and other relief restraining and enjoining Weissman, Cantor, Gorman, and Gentile from violating and/or aiding and abetting violations of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws, Section 17(a) of the Securities Act of 1933 ("Securities Act"), Sections 10(b), 13(a), 13(b)(2)(A), 13(b)(2)(B), and 13(b)(5) of the Securities Exchange Act of 1934 ("Exchange Act"), and Exchange Act Rules 10b-5, 12b-20, 13a-1, 13a-13, 13b2-1, and 13b2-2, and, as to Weissman and Cantor, violating the anti-bribery provisions of the federal securities laws, Section 30A of the Exchange Act. The Commission also is seeking an order that Weissman and Cantor be prohibited from acting as an officer or director of a public company, that the defendants disgorge certain compensation and trading profits, and that the defendants pay civil penalties. SEC SETTLES FRAUD CHARGES WITH ABN AND ABNH In a related action, the Commission filed a settled injunctive action against ABN pursuant to which ABN, without admitting or denying the allegations of the Complaint, consented to an order permanently restraining and enjoining it from violating the antifraud, periodic reporting, record keeping, and internal controls provisions of the federal securities laws, Section 17(a) of the Securities Act, Sections 10(b), 13(a), and 13(b)(2)(A) and 13(b)(2)(B) of the Exchange Act, and Exchange Act Rules 10b-5, 12b-20, 13a-1, and 13a-13. The Commission also instituted and simultaneously settled an administrative cease-and-desist proceeding against ABNH pursuant to which ABNH, without admitting or denying the Commission's findings, consented to an order requiring it to cease and desist from committing or causing any violation, and any future violation, of the antifraud, periodic reporting, record keeping, internal controls, and anti-bribery provisions of the federal securities laws. In connection with this settlement, the Commission filed a civil penalty proceeding and ABNH, without admitting or denying the allegations of the Commission's Complaint, has consented to pay a $75,000 civil penalty for its violation of the anti-bribery provisions of the federal securities laws. SEC SETTLES WITH MACCHIARULO, GOLDBERG, AND LERLO WITH RESPECT TO VIOLATIONS ARISING FROM THEIR CONDUCT AT ABNH Richard Macchiarulo, without admitting or denying the Commission's allegations, has consented to the entry of a Final Judgment settling the Commission's Complaint against him. The Complaint alleges that with regard to fiscal year 1997, Macchiarulo caused ABNH to recognize improperly $1.3 million in revenue on the shipment of unusable work in process to Colorado Plasticard and approximately $6 million in revenue on the MasterCard transaction. The Complaint also alleges that Macchiarulo misled ABN's auditors in connection with their efforts to confirm the MasterCard transaction and that Macchiarulo was aware Colorado Plasticard signed a false audit confirmation with respect to the shipment of unusable work in process at fiscal year-end 1997. The Complaint further alleges that Macchiarulo signed the management representation letter in connection with the fiscal 1997 audit knowing that the letter was false and misleading. The Complaint also alleges that with regard to fiscal year 1998, Macchiarulo caused ABNH to recognize improperly over $5.8 million in revenue on consignment sales and shipments to warehouses during the second and third quarters and that during the fourth quarter, Macchiarulo caused ABNH to record improperly over $11.3 million in revenue on its books and records for, among other things, consignment sales, shipments to warehouses, product that was never shipped, product that was returned, and test material. Finally, the Complaint alleges that Macchiarulo told a friend in December 1998, that it would be a good time for the friend to sell his ABNH stock. According to the Complaint, Macchiarulo's friend then sold his stock and avoided losses of $16,218. Macchiarulo consented to an order permanently restraining and enjoining him from violating and/or aiding and abetting violations of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws, Section 17(a) of the Securities Act, Sections 10(b), 13(a), 13(b)(2)(A), 13(b)(2)(B) and 13(b)(5) of the Exchange Act, and Rules 10b-5, 12b-20, 13a-1, 13a-13, 13b2-1, and 13b2-2 thereunder. Macchiarulo also consented to be prohibited, for a period of ten years, from acting as an officer or director of a public company, agreed to pay disgorgement, including prejudgment interest, in the amount of $19,412.82, representing the losses his tippee avoided, and agreed to pay a $8,109 civil penalty pursuant to the Insider Trading Sanctions Act of 1984. Following the entry of an injunction, Macchiarulo also has consented to the entry of a Commission Order pursuant to Rule 102(e) of the Commission's Rules of Practice, permanently suspending him from appearing or practicing before the Commission as an accountant. The Commission also instituted and simultaneously settled an administrative cease-and-desist and Rule 102(e) proceeding against Mark Goldberg, ABNH's controller from 1993 through June 1997. The Commission found that Goldberg was directly involved in recognizing revenue for, and then confirming to ABN's auditors, the Colorado Plasticard, Gemplus, and KMC transactions which he knew, or was reckless in not knowing, were fraudulent. Without admitting or denying the Commission's findings, Goldberg consented to an order requiring him to cease and desist from committing and/or causing any violation, or any future violation, of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws. Goldberg also agreed to be denied the privilege of appearing or practicing before the Commission as an accountant, with a right to apply for reinstatement in three years. The Commission also instituted and simultaneously settled an administrative cease and desist proceeding against John Lerlo, an ABNH plant manager, for his role in altering documents and creating false memoranda related to the MasterCard transaction. Without admitting or denying the Commission's findings, Lerlo consented to an order requiring him to cease and desist from committing and/or causing any violation, and any future violation, of the antifraud, periodic reporting, record keeping, internal controls and lying to auditors provisions of the federal securities laws. SEC SETTLES WITH ANTONIO ACCORNERO AND RUSSELL MCGRANE, OFFICERS OF COLORADO PLASITCARD, FOR AIDING AND ABETTING FRAUD The Commission also filed a settled injunctive action against Antonio Accornero, president of Colorado Plasticard, and Russell McGrane, CFO of Colorado Plasticard. In its Complaint, the Commission alleged that Accornero and McGrane aided and abetted ABN's violations by assisting ABNH in recognizing, and then confirming to ABN's auditors, the fraudulent "bill and hold" sale for fiscal year 1996 and the $1.3 million sale of unusable work in process for fiscal year 1997. Without admitting or denying the allegations of the Complaint, Accornero and McGrane consented to being permanently restrained and enjoining from violating, or aiding and abetting violations of, the antifraud, periodic reporting, and lying to auditors provisions of the federal securities laws, Sections 10(b) and 13(a) of the Exchange Act, and Exchange Act Rules 10b-5, 13a-1, and 13b2-2, and each agreed to pay a $20,000 civil penalty.