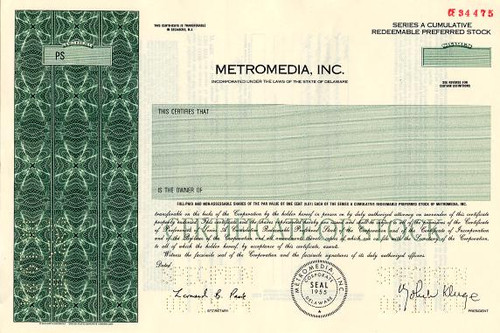

Beautifully engraved certificate from the Metromedia Fiber Network, Inc . This historic document was printed by the American Banknote Company and has an ornate border around it with a vignette of the company's name and logo. This item has the printed signatures of the Company's President (Nicholas M. Tanzi) and its Secretary.

Certificate Vignette Metromedia Fiber Network was founded in 1993 and started with a single franchise in New York City. Its first network became operational in 1996. In 1997, Metromedia Company invested in MFN and the Company made its initial public offering of stock, enabling it to begin expansion outside New York City. Today MFN has grown into a multinational corporation with more than 1,700 employees and with operations in North America, Europe and Asia Pacific. Metromedia Fiber Network, Inc. (MFN) is a global leader in optical networking infrastructure and is the largest supplier of optical fiber in metropolitan areas. Services include full integration of metro-area private optical connectivity, global optical IP connectivity, world-class data centers, and complex web hosting. Metromedia under SEC scrutiny Bankrupt telecom firm says agency opens formal investigation into accounting of 2001 results. June 13, 2002 PALO ALTO, Calif. - Metromedia Fiber Network Inc. said Thursday the Securities and Exchange Commission had begun a formal investigation into its past accounting practices, joining a long list of U.S. companies to come under such scrutiny in the wake of the Enron Corp. accounting scandal. Metromedia, which builds high-speed fiber optic networks in cities and filed for Chapter 11 bankruptcy protection last month, said the probe related to results for fiscal 2001. As Metromedia previously announced, it expects to restate results for each quarter in 2001 due to issues surrounding revenue and sales credit recognition, the timing of expense recognition, as well as noncash lease accounting and purchase accounting issues. First- and last-mile MFN optical connectivity is a critical tool in transforming business because the vast majority of content originates and is utilized within the major cities MFN serves. MFN shatters bandwidth barriers by delivering seamless, end-to-end communications capacity that scales exponentially while enabling customers to realize cost savings and business efficiencies. MFN markets its services directly to carriers, businesses, universities, and government agencies. Chapter 11 looms after Metromedia Fiber Network default on Nortel payment NEW YORK, Apr 01, 2002 (The Canadian Press via COMTEX) -- Metromedia Fiber Network Inc. has replaced its chief executive and head of finance after a missed payment to Nortel Networks Inc. provoked cascading defaults on $673.5 million US in debt. The communications infrastructure operator said Monday that an "event of default" occurred Friday when it failed to make a payment of $8.1 million US on $231 million worth of 14 per cent notes due in 2007 issued to Nortel. "The company was unable to make the interest payment and at the same time satisfy its other near-term cash requirements," Metromedia Fiber Network explained in a statement, as expectations grew that it will file for Chapter 11 bankruptcy protection from creditors. The default on the notes held by Nortel (TSE:NT) triggered cross-default provisions on $442.5 million US in other debt: $150 million worth of notes held by a group led by Citicorp, as well as $62.5 million in notes issued to Bechtel Corp., $50 million in notes held by Verizon Communications Inc., and $180 million in assorted indebtedness to various vendors. All this was in addition to a previously announced "deferred payment" of $30 million due in mid-March on $975 million in notes held by Verizon. MFN also announced that at the close of business on Friday, March 29, 2002, an "event of default" occurred on its $231 million 14.0% Term Notes due 2007 originally issued to Nortel Networks Inc. because MFN did not make its approximately $8.1 million interest payment on the Nortel indebtedness. The Company was unable to make the interest payment and at the same time satisfy its other near-term cash requirements. MFN also announced today that the event of default under the Nortel indebtedness has triggered cross-default provisions on its $150 million Floating Rate Guaranteed Term Notes due 2006 issued to a group of holders led by Citicorp, USA as a holder and as administrative agent, its approximately $62.5 million 8.5% Senior Subordinated Convertible Notes due 2003 issued to Bechtel Corporation, its $50 million 8.5% Senior Secured Convertible Notes issued to Verizon, its $180 million 8.5% Senior Convertible Notes due 2011 and certain of its promissory notes issued to various vendors. As a result, an "event of default" also occurred at the close of business on March 29, 2002 under such indebtedness and the lenders under such indebtedness may accelerate the entire amount of such indebtedness at any time. In addition, MFN previously announced that it deferred payment of approximately $30 million of interest due on March 15, 2002 on its $975 million 6.15% Subordinated Convertible Notes issued to Verizon Communications, Inc. Such interest payment has not been made to date and, if not made prior to the expiration of a 30-day grace period, an "event of default" under the indenture governing these notes will occur. Messrs. Gerdelman and Doherty will be formulating a proposal to MFN's creditors in an effort to restructure the Company's indebtedness. As a result, the Company expects to shortly commence negotiations with the holders of its indebtedness regarding a consensual restructuring. However, there can be no assurances that the Company will reach an agreement with its creditors. As previously announced, if MFN is unable to successfully restructure its indebtedness, the Company may be required to file for protection under Chapter 11 of the U.S. Bankruptcy Code. In addition, any potential restructuring of MFN's indebtedness may result in substantial dilution to MFN's existing stockholders. MFN also announced that it has delayed the filing of its Form 10K for the year ended December 31, 2001 due to the current issues surrounding the Company. The Company is filing Form 12b-25 requesting an extension, and anticipates that it will be filing the 10K by April 16, 2002. Metromedia Fiber Network, Inc. MFN is the leading provider of digital communications infrastructure solutions. The Company combines the most extensive metropolitan area fiber network with a global optical IP network, state-of-the-art data centers, award-winning managed services and extensive peering relationships to deliver fully integrated, outsourced communications solutions to Global 2000 companies. The all-fiber infrastructure enables MFN customers to share vast amounts of information internally and externally over private networks and a global IP backbone, creating collaborative businesses that communicate at the speed of light. Customers can take advantage of MFN's complete, end-to-end solution or select individual components to complement their existing infrastructures. By leasing MFN's metropolitan and regional fiber, customers can create their own, private optical network with virtually unlimited, un-metered bandwidth at a fixed fee. For more reliable, secure and high-performance Internet connectivity, customers can use MFN's private IP network to communicate globally without ever touching the public-switched network. Moreover, MFN's comprehensive managed services enable companies to create a world-class Internet presence, optimize complex sites and private optical networks, and transform legacy applications, all with a single point of contact. PAIX.net, Inc., a subsidiary of MFN and the original neutral Internet exchange, offers secure, Class A co-location facilities where ISPs and other Internet-centric companies can form public and private peering relationships with each other, and have access to multiple telecommunications carriers for circuits within each facility.

Certificate Vignette